FISCAL COURT: Roads, taxes and vehicles discussed by magistrates

Butler County Fiscal Court met in regular session on Monday, August 22, at the courthouse. After approving minutes from the last four fiscal court meetings, magistrates on a 5-0 vote, approved the contract agreement with Green River Equipment Leasing for the Leonard Oak Boat Ramps at the cost of $125,312.50.

The next item on the agenda was setting the county tax rate and acceptance of the health and library tax rates for 2016. The county tax rate remained the same at 8.2% for real estate and tangibles.

Susan Johnson, from the Butler County Judge-Executive's office, presented the Butler County Health Department tax rate at 2.25% for real estate and tangibles.

Kenna Martin, Butler County Librarian, presented the library tax rate at 6.7% for real estate and 12.75 for tangibles.

Butler County Judge-Executive David Fields presented the viewers' report for Green Valley Road and Read Road.

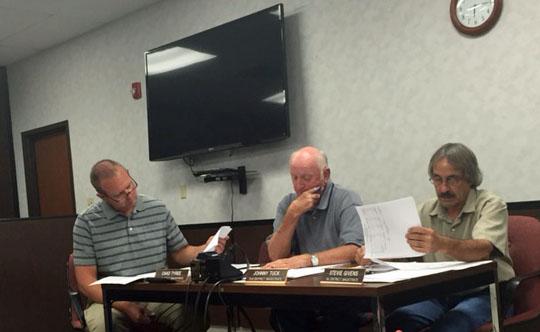

Green Valley Road Landowner Sherry West had requested that a portion of Green Valley Road be removed from the County Road Maintenance Program. Charlie Stuckwisch contested the removal because he owns a farm on the other side of the section West wanted to be removed. Second District Magistrate Johnny Tuck made a motion to table the request; Third District Magistrate Chad Tyree seconded the motion, which was approved by a 5-0 vote.

Regarding Read Road, the landowner requested that a section of the road be removed from the County Road Maintenance Program. Anita and Gary Jackson wanted to make sure they would have access to a cemetery located on Read Road.

"The landowner will give access to anyone wanting to go to the cemetery," said Tyree.

Tyree made the motion to approve the request; Fifth District Magistrate Bobby Moore seconded the motion, which passed by a 5-0 vote.

Jimmy Flener presented the paperwork from property owners Rachel and C. Josh Givens requesting that 246 Mining City Road be added to the County Road Maintenance Program. The house on the road is occupied by Andrea's Mission for Women.

Butler County Sheriff Scottie Ward addressed the court concerning the purchase of a new truck for $26, 937.80.

"We have eight vehicles; one has 240,000 miles, five have over 100,000 miles, and two have less than 100,000 miles," said Ward. "We only have one payment left, and they will all be paid off."

The money is already in the budget to make the first payment according to Ward, and he did not ask for any additional money. The court approved his request by a 5-0 vote.

The court went into closed session under KRS 61.810(F) to discuss personnel. When returning to open session, the court approved hiring Paul Burden as Reeds' Ferry operator at the salary of $24,000 per year plus benefits.

Magistrate Tyree asked the court to consider some amendments to the Fire Dues Ordinance. The court approved the first reading of the ordinance by a 3-2 vote on August 8, 2016.

"I have met with two fire departments, and some of their concerns are the opt-out process, tax bills for people who currently don't receive bills, and the definition of structures in the ordinance," said Tyree.

Tyree would like the application to opt-out of the fire dues to be turned in at the judge's office instead of the local fire departments.

"This would avoid conflicts with the secretaries of the local departments," said Tyree.

He also asked that if an individual currently does not receive a tax bill because the amount is less than $3, they should not receive a bill because of fire dues. According to Tyree, a computer program can be written at the cost of $575 that would eliminate the creation of tax bills for these individuals. There is approximately a little over 700 people in the county that do not receive tax bills. Tyree also stated that structures needed to be clearly defined as there are several individuals that own structures on land that they do not own, thus both the land owner and structure owner will receive tax bills with fire dues added.

Magistrate Bobby Moore requested that people should have to opt-out of fire dues every year instead of a one-time opt-out.

Butler County Attorney Dick Deye said he would draft the requests mentioned, and the magistrates could decide what they wanted to add before the second reading of the ordinance.

Butler county Clerk Sherry Johnson reported that the upcoming Special Election concerning the sale of alcohol in Morgantown, Rochester, and Woodbury will cost the county approximately $10,550. The countywide election costs exceeded just over $22,000.

In other business, the court approved the following:

Bills and transfers

Monthly treasure's report

Transfer from General Fund to Jail Fund $25,000

A check payable to Butler County Ambulance Service for $10,000 (ambulance grant)

A check for $13, 105.71 to Fifth District Fire Department for insurance claim

Budget Amendment

Agreement with The Methodist Home of Kentucky Inc. for temporary placement of juveniles

The next meeting of the Butler County Fiscal Court will be held at Reedyville Community Center at 6:00 p.m. on September 12th.

- Log in to post comments