FISCAL COURt: Flooring work planned for county attorney, circuit clerk's office & courtroom

Butler County Fiscal Court met on Monday, November 13, at the courthouse. All five magistrates were in attendance.

Butler County Clerk Sherry Johnson gave her third-quarter update. As of October 31, her office had received $6,089,000; she had only budgeted for five million. According to Johnson, the election went well, with 3,668 people voting for a 40 percent turnout.

The court approved the First District Volunteer Fire Department's financial statement for the third quarter.

Judge/Executive Tim Flener recommended Katie Gary and Leeann Hudnall to the Butler County Extension Council. The court approved his recommendations.

Magistrates also approved a bid from Williams Flooring for $1,975.20 for the Butler County Attorney's office.

The Administrative Office of the Courts informed the court they are replacing the flooring in the courtroom, circuit court clerk's office, and jury room at a cost of $17,747.10.

The court approved litter abatement payments to Friends of Butler County Animals $461.90; Belmont Missions $511.50; BC ATC Hosa $494.90; Reedyville Community Center $630.70; BCHS Track & Field $ 533.70; BCHS Football $650; BCMS Volleyball $462; BCHS Golf $ 500; and Salem Youth $ 599.

Magistrates approved changing a seasonal employee to part-time under 100 hours for the road department. They also approved having a truck checked for transmission problems at Westerfield's.

According to Judge Flener, the county hopes to sign paperwork with AeroSpce Composites and the city of Morgantown this week, and construction will start on December 1, for the joint project. He is also expecting an update on the regional jail this week.

The Court approved the following:

--Bills and transfers

--Transfer $35,000 from the General Fund to the Jail Fund

--Payment for elected officials completing 40 hours of training

--Payment of Transient Tax for July-September 2023: $2688.18

--Refund of $5,014.88 to Eaton Asphalt Company for taxes paid to the wrong state

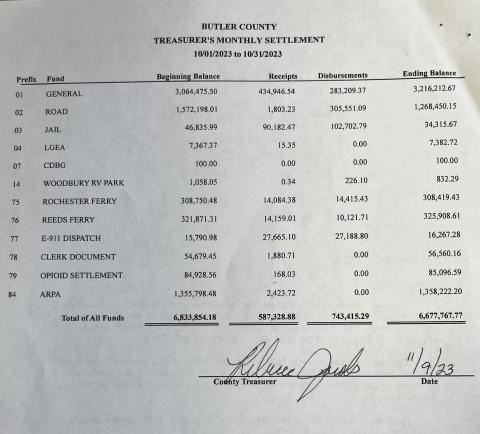

--Monthly Treasurer's Settlement