Fiscal Court, county employees grapple over increases in health insurance package

Butler County Fiscal Court met in regular session for approximately 68-minutes on Monday night. All members were present along with several county employees, elected officers, and interested parties. In the meeting’s opening six minutes the court handled routine monthly business, approved a resolution accepting a Community Development Block Grant through the Barren River Area Development District, and approved up to $45,000.00 in transfers from the General Budget to the Butler County Jail.

The meeting’s final 62-minutes was dominated by more than an hour’s discussion of the employee health insurance package accepted by the court during its April 5, 2012 called meeting. At issue is the increase passed on to employees using the dependent and family plans offered under the new plan.

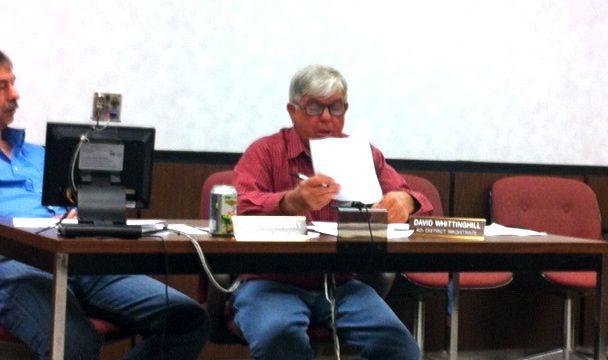

Magistrates voted on Thursday night 4-1, with David Whittinghill casting the ‘nay’ vote, to increase the employee’s portion of the family and dependent care premium to 30% from the 20% paid on the single employee plan. The twenty percent figure had been in place for several years on the county health insurance plans. Kelly Harding and Gina Tynes, representing Hocker Family Insurance, explained Thursday night that the actual premium costs were increasing 8% across the board for the 2012-13 fiscal year insurance package. The court decided to raise the employee contribution on family and dependent plans to 30% and to require that newly elected or hired employees require their spouse to use their employee health benefits as their primary coverage provider. The change was because of the increasing number of employees enrolled in the plan.

The actual cost passed on to employees was misunderstood by the magistrates, according to David Whittinghill. Whittinghill, representing 4th District, asked to reopen discussion of the insurance plan on Monday night. Several county employees were on hand expressing their concerns and frustrations at the new plan, which raised family and dependent care plans to approximately $250.00 every two weeks, an increase of approximately $90 per pay period for insurance. All told the percent increase per employee on the dependent or family plan is approximately 61%.

Emergency Management Director Terry Hunt, who is not covered by county health insurance, said that he has been employed by Butler County since 1978 and doesn’t recall an increase approaching the amount of the 2012-13 jump. “It don’t do no good to work forty hours a week if you can’t pay your bills and put food on your table,” said Hunt. Hunt’s fear is that employees will be forced to drop their coverage all together because of the high price.

Anthony Perrin, the mechanic with the County Road Department, asked if the county could get prices from other providers and for other plans. Other visitors echoed his thoughts and wondered if the plan could be left up for bid even though the bid from Hocker Family Insurance had be accepted. Keith Daugherty and former County Judge Executive Hugh C. Evans explained that because of Kentucky law the number of providers is limited. Judge Fields said that the employees need to be enrolled by May 1st when the new insurance plan goes into place. Fields said that the county would be locked into this plan for a year.

It was also suggested that the county go with the state of Kentucky’s insurance plan. Third District Magistrate Chad Tyree said that enrolling in the state plan would cost $60,000 more in premiums with less coverage.

Danny Grubb, with the County Road Department, remarked that the increase has lowered his take-home pay to approximately $30 less for two weeks than he made with the county in 1999. Grubb said that he went to work for the county in 1999 for $7.50 per hour. “When I went to work here I was kinda trying to supplement my farm income. Now I’ve got to farm to supplement my county income,” said Grubb. Grubb asked Judge David Fields if the increase was made to help balance the budget, and Fields acknowledged that it was. To that Grubb said, “The public enjoys the sheriff’s protection, they enjoy the good roads. You’re going to have to get a few more people in on this budget deal, and not just a little group.” Grubb suggested that it might be time to raise taxes to balance the budget instead of placing the burden on a small group.

Judge Fields explained that costs are increasing for the county across the entire budget. One example was the Butler County Jail. Fields said that the Jail budget went up more than $170,000.00 due to new state regulations and requirements. Said Fields, “Everything is going up except the receipts,” to which County Road Supervisor Timmy West responded, “That’s where the employees feel it too, everything is going up except the wages.”

Second District magistrate Johnny Tuck said the increase was more than he realized it would be, and wants to try to find a way to relieve at least part of the burden on employees. Fields explained that instead of paying 20% of an approximately $1,479.00 premium that employees were paying 30% of approximately $1,700. This means that employees are seeing an 8% increase on their basic premium, plus are now responsible for an additional 10% contribution of the overall premium, for an increase of approximately 61%.

David Whittinghill finally ended the discussion by making a motion to return dependent and family plan employee contributions to 20% of the premium. After some discussion Johnny Tuck seconded the motion saying, “I hate to break the county, but we need to help.” After some more discussion David Whittinghill withdrew his motion to go back to the 80-20 plan and no vote was called for.

Shane Wells, with the Butler County Soil Conservation District, was a late arrival at the meeting and was allowed to be put on the agenda. Wells wanted to speak with the court about cuts to the Conservation District’s budget. At the May 5th special session the Court announced that a $10,000.00 cut would be made to the Conservation District budget. Wells said that a cut to their office would cost at least one employee, and that possible federal cuts put the entire office in danger of closing. Echoing the previous discussion Judge Fields told Wells that the cuts were required to balance the budget and that cuts were made to more than just the Conservation District’s budget.

No action was taken on Wells’ concerns.

With nothing more on the agenda the meeting was then adjourned.

The Fiscal Court meets in regular session on the second Monday of every month at 6 o’clock in the upstairs courtroom of the Butler County Courthouse. All meetings are open to the public. The next regular session of the Fiscal Court will be May 14th at 6 p.m.

* * *

Story by Joe K. Morris, Beech Tree News.

- Log in to post comments

Comments